\n

\n

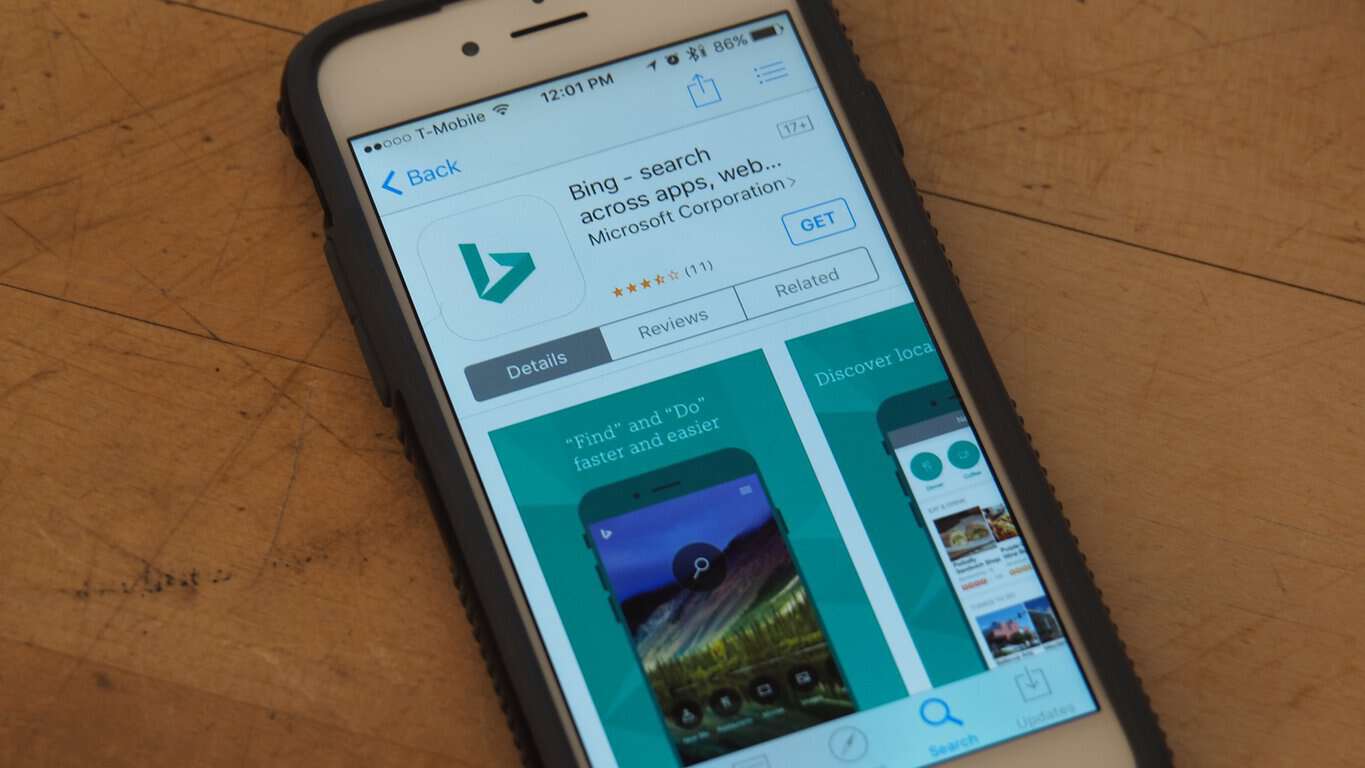

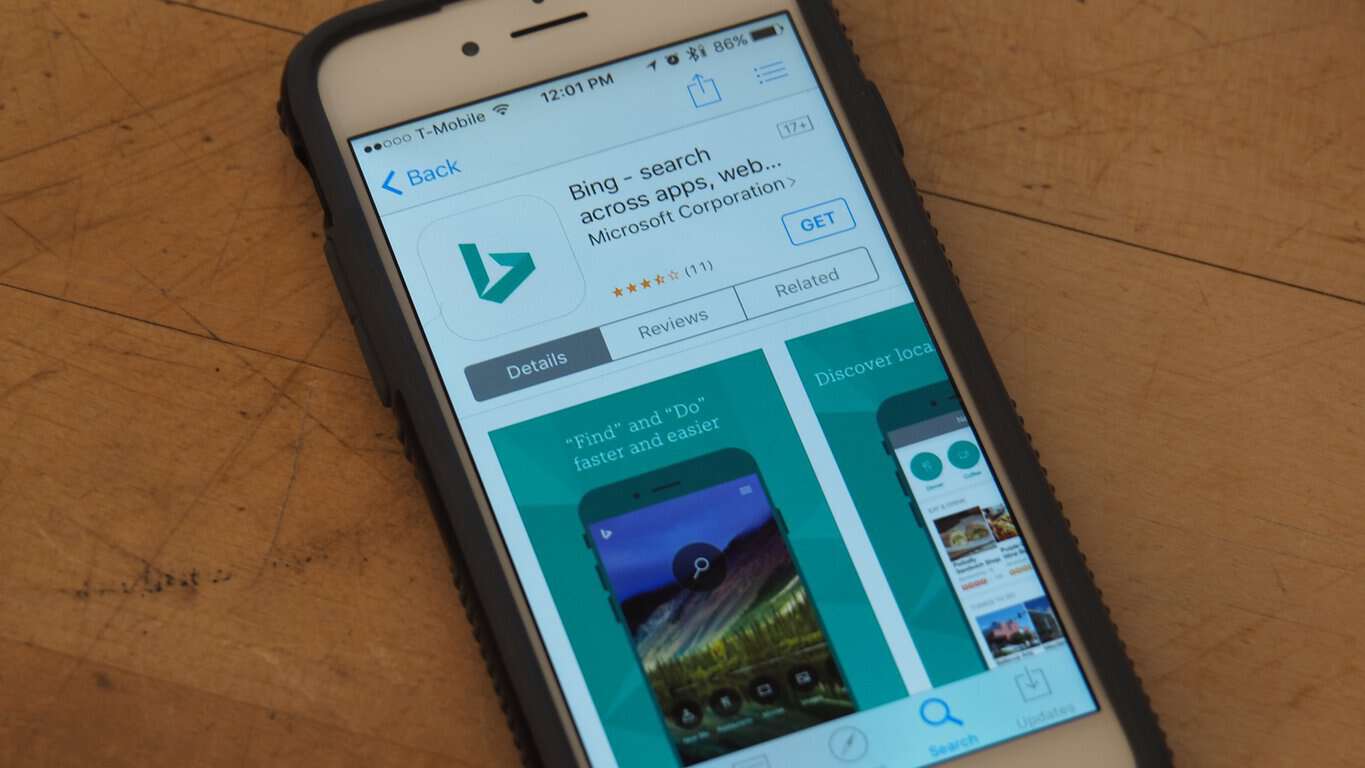

Today, Bing got a rather large upgrade in features and services for iOS users. Bing added the capacity to take a picture and search the web using that image, the ability to get Bing notifications on movies when they are available for streaming and other features as well as performance and bug fixes.

\n

Here’s the full changelog for Bing (Version 6.5.1) for iOS:

\n

\n

\n

- Get notified when a movie you’re following is available for streaming

\n

- Search by image: take a picture, and find similar images from the web

\n

- Find bus routes and schedules from maps

\n

- Faster start-up time and other performance improvements

\n

- Improved image, video, and local experience

\n

- Improved product results, with data from more stores (including eBay, BestBuy) in the barcode scanner

\n

\n

\n

Microsoft continues to add features that have been available on Windows 10 and Windows phones to Bing apps on iOS and Android. Bing will continue to evolve on iOS as Microsoft strives to provide a unified experience across all platforms.

\n

Download Bing for iOS from iTunes.

\n\n