Microsoft FY21 Q1: Cloud businesses supercharged by pandemic

3 min. read

Published on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Microsoft’s fiscal year earnings are out and it seems thanks in large part to the pandemic, the company floats another impressive revenue-generating quarter.

In a turn of events from its last earnings report where the company noted that COVID-19 had a “minimal” negative impact on its bottom line, it now seems that three months later that COVID-19 has had a substantial impact on Microsoft’s bottom line for a net positive.

According to Microsoft’s newly released FY21 Q1 earnings report, the company managed to beat revenue expectations of $35.76 billion to post an impressive $37.2 billion for the quarter.

The end result for investors was an earnings gain of $1.82 per share versus the street prediction of $1.55 and much of that growth was on the back of the company’s Intelligent Cloud which saw 48% revenue growth from this time last year.

Microsoft executive vice president and CFO Amy Hood highlighted the extraordinary circumstances of the pandemic and how the company is uniquely positioned to capitalize on its tangential effects.

“Demand for our cloud offerings drove a strong start to the fiscal year with our commercial cloud revenue generating $15.2 billion, up 31% year over year. We continue to invest against the significant opportunity ahead of us to drive long-term growth.”

Revenue in Productivity and Business Processes was $12.3 billion and increased 11%, with the following business highlights:

- Office Commercial products and cloud services revenue increased 9% driven by Office 365 Commercial revenue growth of 21% (up 20% in constant currency)

- Office Consumer products and cloud services revenue increased by 13% and Microsoft 365 Consumer subscribers increased to 45.3 million

- LinkedIn revenue increased by 16%

- Dynamics products and cloud services revenue increased 19% (up 18% in constant currency) driven by Dynamics 365 revenue growth of 38% (up 37% in constant currency)

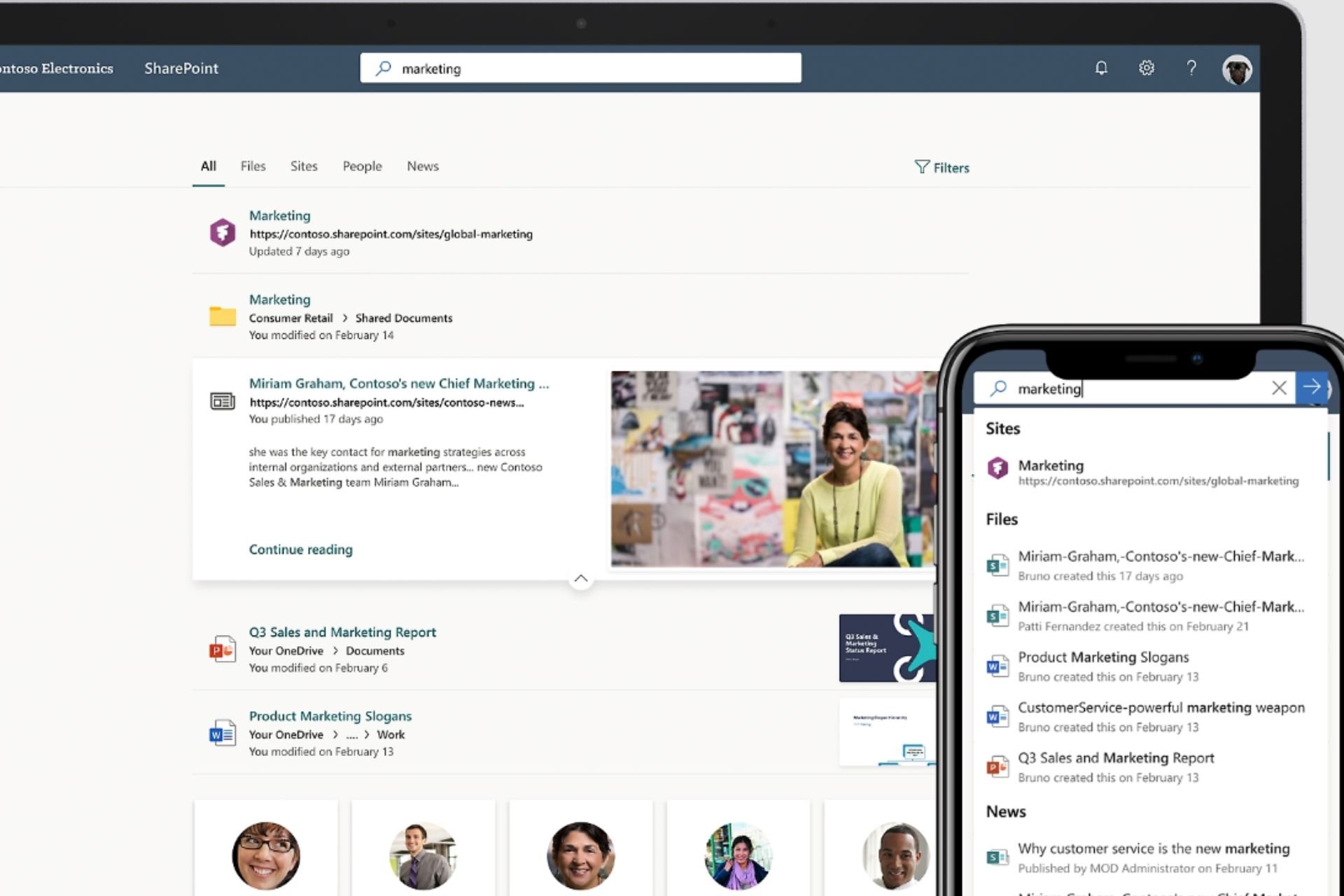

Revenue in Intelligent Cloud was $13.0 billion and increased 20% (up 19% in constant currency), with the following business highlights:

- Server products and cloud services revenue increased 22% (up 21% in constant currency) driven by Azure revenue growth of 48% (up 47% in constant currency)

Revenue in More Personal Computing was $11.8 billion and increased 6%, with the following business highlights:

- Windows OEM revenue declined 5%

- Windows Commercial products and cloud services revenue increased 13% (up 12% in constant currency)

- Xbox content and services revenue increased by 30%

- Surface revenue increased 37% (up 36%in constant currency)

- Search advertising revenue excluding traffic acquisition costs decreased by 10% (down 11% in constant currency)

At the end of the day, investors walked away happy with Microsoft returning $9.5 billion to shareholders through repurchases and dividends, which translated to a 21% increase in stock value year-over-year comparatively.

Interestingly enough, despite more people working from home and PC manufacturers in the US seeing their first increase in shipments in close to a decade, Microsoft’s More Personal Computing business seemed to be the albatross on the company’s back this quarter. Surface sales were down, Windows OEM Pro revenue was down 22% and Search is still trending downward.

Nadella will be giving guidance on the next quarter later today and we’ll have to see how Microsoft plans to address its MPC sector as businesses go into extended work-from-home situations, so that the MPC sector doesn’t start offset gains from the cloud.